Climate change concerns are intensifying, and both companies and sports organizations are under growing scrutiny for their carbon emissions. You need to know how these organizations are being regulated and what happens if they don’t comply. As regulations become increasingly complex, it is vital to understand the frameworks in place, penalties for non-compliance, and the broader consequences of failing to meet emission standards.

Regulatory Frameworks in Place

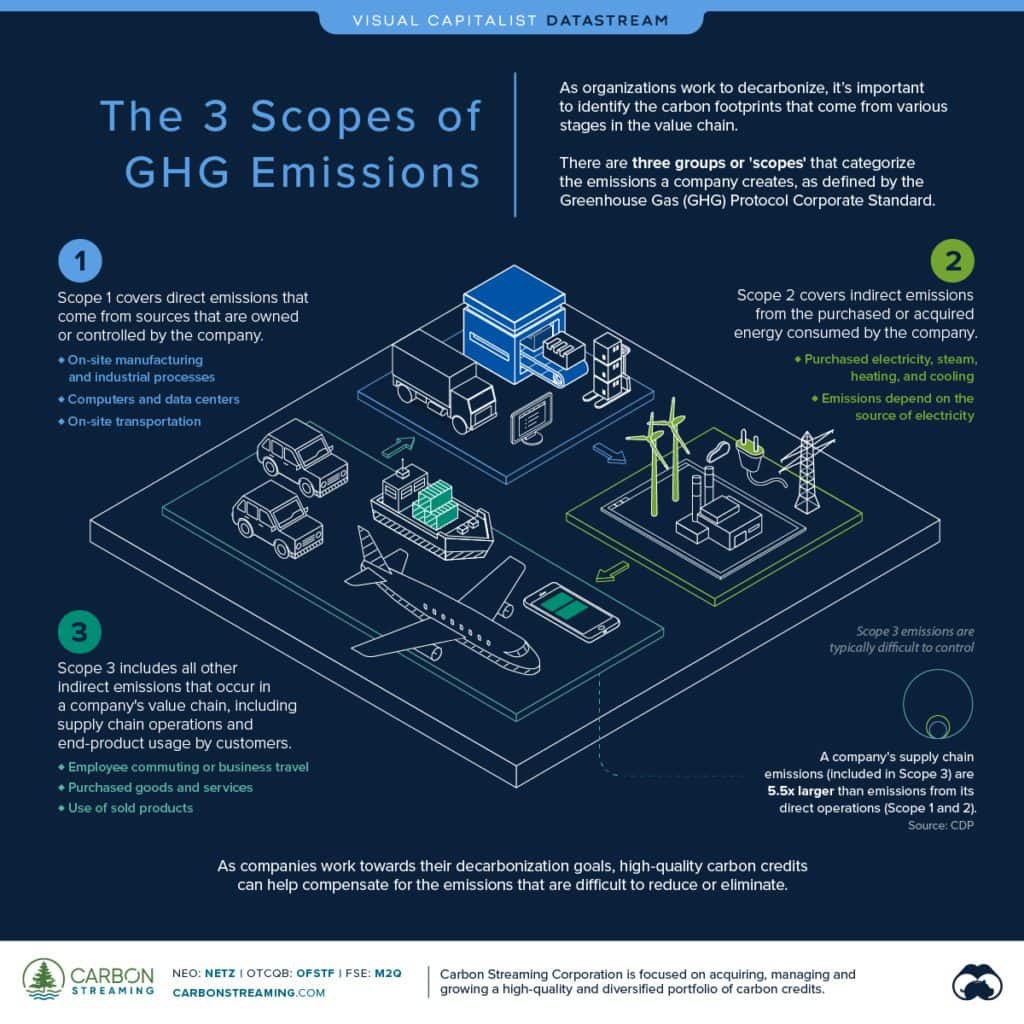

Companies and sports entities are required to disclose their CO2 emissions. Standards like the Greenhouse Gas Protocol are used to categorize emissions into three scopes:

- Scope 1: Direct emissions from owned or controlled sources.

- Scope 2: Indirect emissions from purchased electricity.

- Scope 3: Other indirect emissions from the entire value chain.

In the sports sector, organizations like UEFA have rolled out initiatives such as the Football Sustainability Strategy 2030 to align their goals with international environmental frameworks to reduce emissions. Sports clubs are beginning to understand that their influence stretches beyond the field; they promote environmental sustainability within their organizations and across the communities they serve.

However, there isn’t a universal standard for emissions reporting in sports, resulting in discrepancies in how clubs report their environmental impact. While specific organizations are setting good examples, inconsistencies make it challenging to assess overall progress. Regulatory pressure, especially in Europe, is growing, and clubs that fail to address emissions properly will likely face more stringent penalties soon. This regulatory push is aimed at achieving not only organizational accountability but also setting a precedent for more sectors to take emissions management seriously.

Penalties for Non-Compliance

Companies that fail to report CO2 emissions face substantial penalties accurately. These vary by country and region:

United States: Under proposed SEC climate rules, companies may face fines, legal actions, and reputational damage for inaccurate reporting. For example, Fiat Chrysler was fined $9.5 million for inadequate emissions disclosure. Beyond financial penalties, companies risk losing investor confidence, which can lead to long-term capital limitations.

European Union (including Sweden): The EU Emissions Trading System (EU ETS) imposes a penalty of €100 per tonne of unreported CO2. Penalties under the Carbon Border Adjustment Mechanism (CBAM) range from €10 to €50 per tonne, increasing with non-compliance duration. Sweden, as part of the EU, has additional stringent regulations. The Swedish carbon tax, introduced in 1991, currently stands at around SEK 1180 (€110) per tonne of fossil CO2 emitted, which is among the highest rates in the world. Companies that fail to comply can face substantial financial penalties. The carbon tax has contributed to an 11% reduction in CO2 emissions from transport, highlighting the impact of stringent regulation on emission reductions. Sweden’s climate framework also includes yearly climate reports and action plans, which further hold companies accountable and align national policy with long-term sustainability targets.

United Kingdom: The Environment Agency can impose fines of £40 per tonne of incorrectly reported emissions, mainly when the discrepancy is significant. There are also enforcement actions under the Energy Savings Opportunity Scheme (ESOS), which include civil penalties for companies that fail to carry out mandatory energy assessments.

Australia: Recent legislation requires large companies to disclose climate-related data, with potential multi-million dollar fines for non-compliance enforced by the Australian Securities and Investments Commission (ASIC). The focus is not only on financial compliance but also on ensuring that organizations have adequate systems in place to measure, manage, and disclose their emissions data in an accessible manner.

Other Scandinavian Countries

Other Scandinavian countries like Norway, Denmark, and Finland also impose carbon taxes. Norway and Finland introduced carbon taxes in the early 1990s, similar to Sweden. Penalties for non-compliance typically include significant fines, with the tax rates adjusting based on inflation and carbon pricing guidelines. Norway has also linked its carbon tax system with the EU ETS, creating a cohesive regional approach to emissions control and management. Denmark, on the other hand, has implemented a mix of carbon taxes and renewable energy incentives to drive down emissions across multiple sectors. In these countries, non-compliance can lead not only to direct financial penalties but also to higher operational costs due to restrictions on energy use.

Asia

While penalties in Asian countries are generally less stringent compared to Europe, there are notable examples of strong enforcement. In South Korea, non-compliance with the emissions trading system can lead to fines of up to three times the market value of the excess emissions. Japan has also implemented measures requiring accurate emissions reporting, with non-compliant companies subject to financial penalties and public disclosure, which damages reputations. China is also emerging with stronger enforcement mechanisms for its emissions trading system, targeting companies that fail to meet reporting guidelines and setting the groundwork for future international collaborations in emissions reduction.

These penalties highlight why transparent CO2 reporting is key to meeting Environmental, Social, and Governance (ESG) goals. A failure to comply not only results in financial penalties but also impacts a company’s reputation, operational continuity, and long-term sustainability prospects.

Long-term Consequences of Inaccurate Reporting

Failing to accurately report CO2 emissions can damage your company’s reputation and financial health. Misreporting emissions erodes public trust and can lead to a loss of consumer loyalty. Investors prioritizing sustainability may divest from companies with poor carbon practices, impacting stock performance. Inaccurate reporting also opens the door to legal liabilities, which can have extensive financial implications beyond initial penalties. Regulatory bodies are increasingly collaborating internationally, meaning non-compliance in one jurisdiction can affect operations in others.

Take Volkswagen as an example. Their emissions scandal led to a steep decline in stock value and a major loss of trust from consumers and investors. Additionally, Volkswagen faced billions of euros in fines and costs associated with rectifying the damage. The scandal serves as a reminder that the consequences of poor CO2 reporting extend far beyond immediate penalties; they can include years of operational, financial, and reputational setbacks.

Moreover, regulatory non-compliance may limit your access to capital markets. Investors are increasingly using ESG metrics to determine funding allocations, and companies that need to meet emissions standards may find themselves cut off from essential sources of capital. Poor CO2 reporting also has an internal effect: employee morale and talent acquisition may suffer as younger generations increasingly seek employers with a commitment to sustainability.

How You Can Improve CO2 Reporting

To avoid these consequences, you need a solid carbon reporting framework:

Set clear targets: Define measurable emissions reduction goals. Start by assessing your current emissions footprint, and set short- and long-term targets that align with broader industry standards.

Collect precise data: Use accurate data collection methods to get reliable emissions figures. This means employing both internal tracking systems and third-party verifications to cross-check data quality. Consistency in data collection is key to avoiding discrepancies that could lead to penalties.

Adopt carbon accounting tools: Use software to streamline data management. Many companies are turning to AI-based tools to help automate the process, which reduces the chance of human error and ensures that all data points are captured accurately.

Leadership accountability: Appoint a Chief Sustainability Officer (CSO) to ensure environmental strategies are handled properly. This position should be empowered to implement sustainability initiatives across the entire organization and hold each department accountable for their emissions targets. The CSO must also stay updated on regulatory changes to keep the organization ahead of compliance requirements.

Clear communication with stakeholders is also essential, especially in crisis situations. Acknowledge any errors honestly and work to fix them. Rebuilding trust takes time and requires consistent improvements and transparency. Companies that communicate effectively are more likely to recover from reputational damage than those that attempt to obscure problems.

You should also consider engaging with external auditors to validate your emissions reporting. Having an independent verification adds credibility to your reporting efforts and helps preempt any regulatory issues before they escalate. Integrating sustainability into corporate culture can also drive engagement at all levels, making it easier to achieve emissions goals.

Looking Forward

The regulatory landscape is evolving. Accurate carbon reporting isn’t just about avoiding fines—it’s about contributing to a sustainable future where businesses positively impact global environmental health.

Sources and Further Reading

For more information on the regulatory frameworks, penalties, and strategies mentioned in this blog post, you may refer to the following sources:

- Sweden’s Climate Act and Policy Framework – Naturvårdsverket

- Burges Salmon on Penalties for Non-Compliance with Climate Regulations

- Carbon Taxes and CO2 Emissions: Sweden as a Case Study – American Economic Journal

- Carbon Pricing Leadership Coalition on Sweden’s Carbon Tax

- International Energy Agency on Global Emissions Policies

- European Environment Agency on EU Emission Regulations

- US Environmental Protection Agency on Emissions Reporting

- Ministry of Environment, South Korea – Emissions Trading System

- Norwegian Environmental Agency on Carbon Tax Policy

- Japanese Ministry of the Environment on Carbon Emissions Reporting

- Korea Emissions Trading Scheme